www.citi.com/activate – Activation process for Citi Credit Card Account

Activate, Apply your Citi Bank Credit Card:

Citi Bank is the consumer division of the Citi group. This financial service company was started in 1812 as the City Bank of New York. They operate around 2,649 branches across 19 countries, including the 723 branches in the United States. The US branches are mainly located in six metropolitan areas, Los Angeles, San Francisco, New York, Chicago, Washington, D.C., and Miami. They provide several products, such as credit cards, mortgages, personal loans, commercial banking, lines of credit, etc.

How to Activate Citi Bank Credit Card:

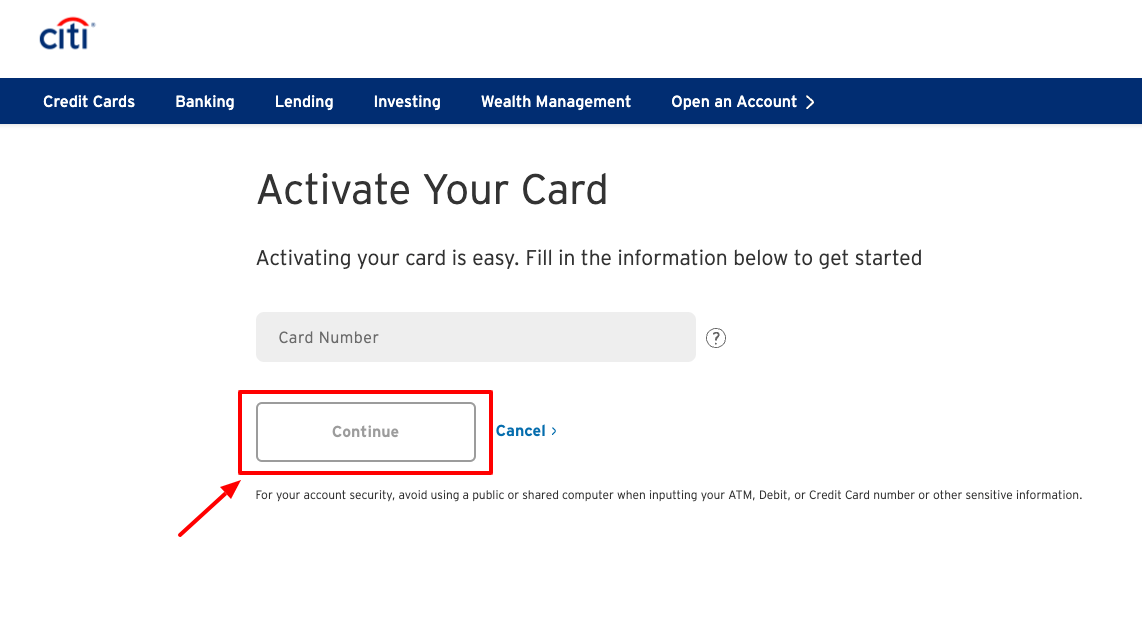

Before the first use, you must have to activate the Citi Bank Credit Card. Make sure that you have your credit card with you while activating your card. To activate your Citi Credit Card by following these easy steps below:

- Firstly, you need to click on this link www.citi.com.

- As you landed on the right side of the page, you will see the login section.

- There, under the Login section, you just need to click on Activate a Card option, or directly go to the www.citi.com/activate page.

- You have to enter your Citi Card number on the given field.

- After that, you just need to click on the Continue button to successfully activate your card.

Some of The Top Credit Cards Offered by Citi Bank:

Citi Bank provides several credit cards for customers. These are some of the best credit cards offered by Citi Bank:

Citi Premier Card:

The Citi Premier Card is a great middle-tier travel reward credit card that comes with both a solid sign-up bonus and an excellent return on a variety of spending categories. After spending $4,000 in purchases within the first 3 months of account opening, you will get 60,000 bonus ThanYou Points. Also, you will get 3x points for every dollar you spent at supermarkets, restaurants, gas stations, air travel, and hotels. On all your other purchases, you will get 1x points for every dollar with this credit card.

ThankYou Points can be redeemed for cash rewards or gift cards at 1 cent per point. You can also transfer ThankYou Points to more than a dozen airlines, including Air France/KLM, JetBlue, and Virgin Atlantic.

Citi Prestige Credit Card:

Citi Prestige Credit Card is one of the best travel credit cards that offer luxury travel prices. This credit card has a $495 annual fee which might scare off many potential cardholders. If you are a frequent traveler, then this annual fee might be well worth it for the luxury travel benefits.

This credit card has an industry-leading earring rate. Here, you can earn 5x points at the restaurant and for air travel purchases. You will receive 3x points for hotel and cruise purchases, and 1x for all the other purchases.

Based on how you travel, the complimentary fourth-night hotel stay benefits might be worth the fee on their own. If you book a stay at least four nights via thankyou.com, then you will get one free night. You can use this benefit twice every year.

Citi Double Cash Card:

If you are looking for a cash-back credit with no annual fee, then you can choose the Citi Double Cash Card. It has 2% on every purchase with unlimited 1% cashback when you buy with this card. Plus, there is an additional 1% as you pay for those purchases. After you earn a total of $25 of cashback, you can redeem your cash back for a check, credit statement, or transfer to a Citi checking or savings account. You can also convert your cash rewards of this card to the Citi ThankYou Points.

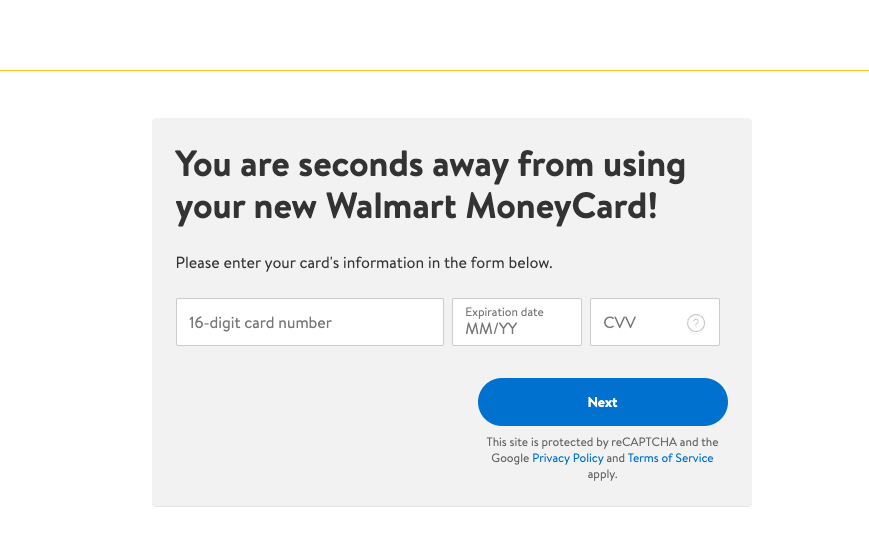

Also Read: Walmart MoneyCard Register Online

CitiBusiness/ AAdvantage Platinum Select Mastercard:

The CitiBusiness/ AAdvantage Platinum Select Mastercard is one of the best cards for businesses looking to earn airline miles while leaving the travel on American Airlines. Every time, you fry with American Airlines, you will get a free preferred boarding, a free checking bag on domestic flights, and 25% savings on in-flight Wi-Fi, food, and beverage purchases.

This Citi Credit Card also offers some solid rewards rates. Here, you can earn 2 AAdvantage miles for every dollar you spend on eligible American Airlines purchases. You will get 2 AAdvantage miles for $1 spent on purchases at telecommunications merchants, cable and satellite providers, gas stations, and car rentals merchants. On all the other purchases, you will get 1 AAdvantage mile for every dollar you spent.

How to Apply for Citi Bank Credit Card:

If you don’t have a Citi Bank credit card, then you can follow these simple instructions below:

- Firstly, you need to click on this link www.citi.com, for direct access to the Citi website.

- There, under the Credit Card option, select the View All Credit Cards.

- Then, under any specific credit card, you have to click on the Learn More & Apply option.

- On the next page, you have to select the Apply Now option for steps further.

- You have to enter all the required details on the next page for the steps further.

- Then, you can simply follow the on-screen guideline to apply for the Citi Bank credit card.

Citi Bank Contact Info:

For any queries about the Citi Bank credit card, you can contact the customer service department.

General Supporting: 1-800-950-5114

TTY: 1-800-325-2865

Mail:

Citibank Customer Service

P.O. Box 6500

Sioux Falls, SD 57117

Reference Link: