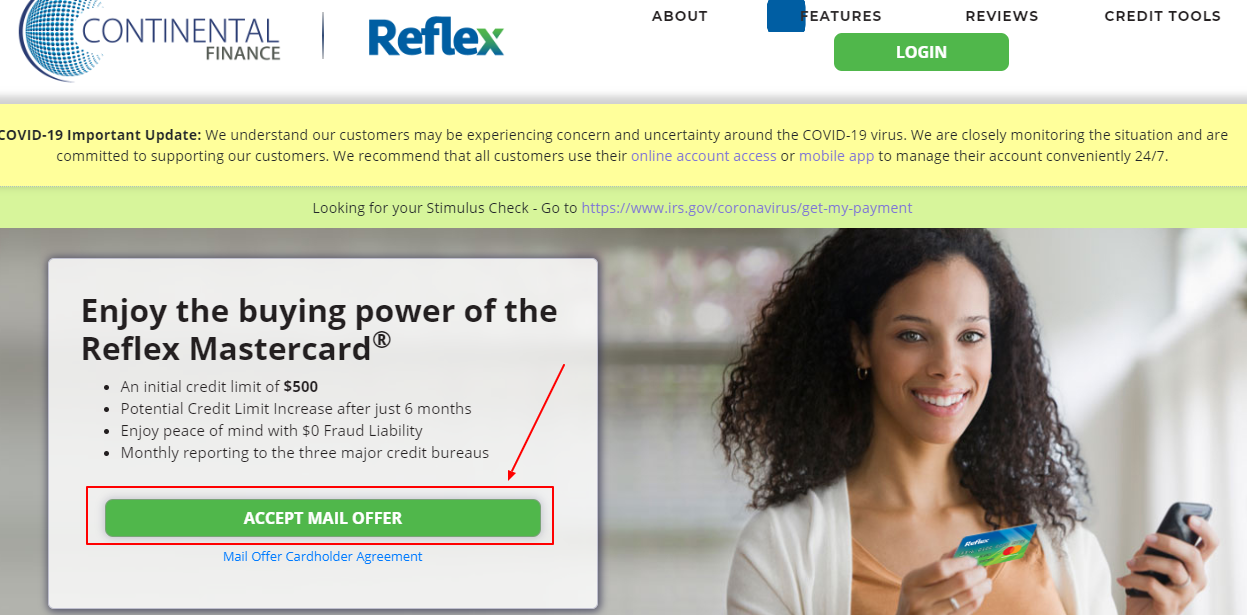

www.reflexcardinfo.com – Reflex MasterCard – Application, registration, and online access

Reflex MasterCard is issued by the Celtic Bank which was founded in the year 2001. Celtic Bank has been always leading and still leads in lending funds for residential construction and small business. It is currently ranked as the eighth largest SBA lender in the United States of America. In partnership with Continental Finance, which is the primary finance, Reflex MasterCard has been introduced to give the customers the experience of the credit card with very little hassle.

Continental Finance manages more than 2.6 million credit cardholders. Reflex MasterCard is specially designed for the ones who have an average or lesser credit score. With this, you are not only getting every facility of MasterCard but also get a full-fledged chance to rebuild your credit score by making your monthly payment on time and maintain the balance within the credit limit.

Why apply for Reflex MasterCard

Here are the points that make Reflex MasterCard a much needed financial partner you should have in your wallet.

- It comes up with a credit limit of $500.

- Shop online and offline, transaction and withdraw cash from every POS and ATMs wherever MasterCard is available.

- $0 Fraud Liability giving you much-needed peace of mind.

- Build up your credit limit with a good track record of payment within six months of card activation!

- Free Credit Score every month via e-statements from three major credit bureaus- Equifax, TransUnion, and Experian.

- Apart from the credit score, you can get a detailed report helping you to understand more about your credit status and ways to improve it.

- Integrated mobile app enabling you to manage your account from any time and anywhere via your mobile and tablet device.

- Make the payments, check the date, and check the e-statement with the online account management.

- A separate web base is known as Knowledgebase to give the cardholders and clients guidance about the way to build credit, credit utilization, and many other credit topics.

- Each Reflex Credit Cardholder is entitled to Credit Protection Program, protecting your card, transactions, and funds from any fraudulent activities.

Application requirements and procedures

What are you waiting for? Get started with the application process real quick. Three aforementioned credit bureaus check the records if finance and credit of the possible applicants and send them mail and email to their residential address and email address respectively with mail acceptance offer. However, no need to be dejected if you do not receive the one. Here you will learn, how to apply for the Reflex MasterCard, with or without Mail Acceptance Offer:

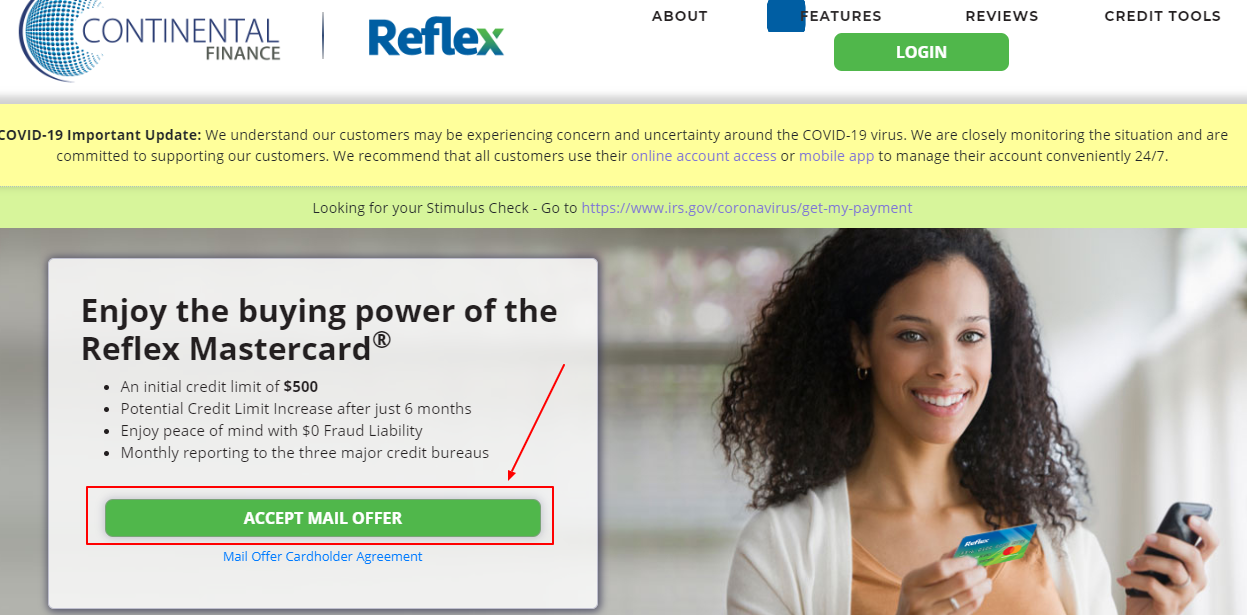

- Open your browser and visit www.reflexcardinfo.com.

- Click on the Accept Mail Offer Before proceeding you would like to read terms and conditions by clicking Mail offer Cardholder Agreement.

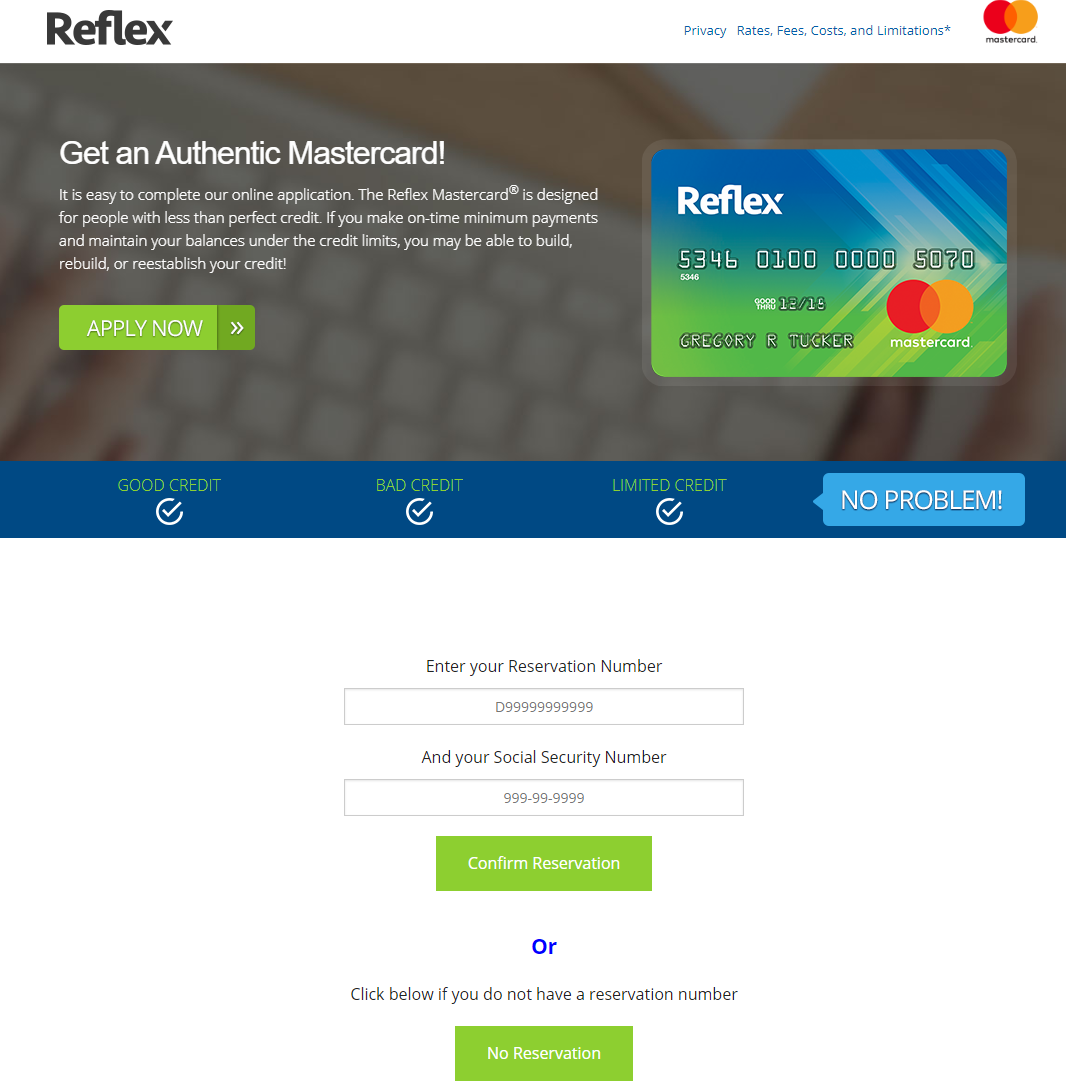

- Applicants with Mail Acceptance Offer should look into your mail and enter their unique Reservation number exactly as printed.

- Next enter the Social Security Number of the applicant.

- Click on Confirm Reservation.

- Tap on the No Reservation tab if you do not have an offer.

- Enter the following information one by one:

- First Name.

- MI

- Last Name.

- Home Address.

- Address Line 2.

- ZIP Code.

- Email Address.

- Primary Phone Number with Phone Type.

- Secondary Phone Number with Phone Type (if any).

- Time of Residence Years and Months.

- Please select the status of your residence from the dropdown given.

- Please specify if you have an active checking account.

- Confirm if you are a legal resident of the United States and age 18 or above(19 in case of residents of Alabama)

- Tap on Continue your application.

- One with mail application offer does not require entering the above-mentioned info. From here, both with and without offer need to provide some more details regarding their identification, annual income, income source, bank account details and some more information for the application

- Check all the information entered and submit them. Most of the time, the decision is instant. In case, Celtic Bank requires more information, this will inform you accordingly and collect which may take up to 30 days to process.

Receiving and activating Credit Card

After the application for the Reflex MasterCard, if it gets approved, it takes just a few days to dispatch a brand new credit card to your doorstep. The new Reflex Credit Card comes bundled up with welcome material consisting of crucial info and manual about card usage, rate, late payment fees, APR and many more. Reflex Card is mailed within 3 business days.

After getting your physical card, you are required to call from any of your contact numbers entered during the application process (Primary/Secondary Phone Number) to activate the toll-free number affixed at the back of your new card. Telephonic activation must be made within 30 days of receiving the card.

Reflex MasterCard Online Banking Service

After activating your card, it’s time for you to enroll your card with Online Banking Service. Enrolling with the online banking service is just as easy as application. On registering online, you will activate the following features:

- Online Credit Card payment via both AutoPay feature as well as one-time online payment.

- Check the recent and pending transactions.

- Check the balance and the related information of your card.

- View, download and share your recent as well as previous e-statement.

- Monthly receive an account statement to your email address.

- Look out for the payment history.

- Access special customer support helpline.

Enrolment Process

All you need is to simply register with the Reflex Online Banking. You are free to access your credit account anytime and from anywhere with just a device and data connection.

- Please log on to www.reflexcardinfo.com.

- Scroll down to the Online Account Management section and tap on Learn More.

- Beside Need an account, click on Register Now.

- Keep on entering the following information to verify the identity of cardholder’s credit card account:

- Last four digit of Credit Card number.

- Social Security Number, last four digits.

- Birthdate (mm-dd-yyyy) of the cardholder/ZIP Code as in 5 digits.

- Tap on Lookup Account and go through the prompt to set up a username and password for online banking as well as security questions and answers.

Logging into Reflex MasterCard Online Banking Service

Accessing your Online Banking account is easy now. Take control of your finances logging in the following way:

- Directly log on to www.yourcreditcardinfo.com/. Book mark the online credit card management page for subsequent use.

- Type in your username you had set during online banking registration.

- Enter your password.

- Select the Login

Retrieve Username

Next, please go through this step if you ever forget your username:

- Log on to www.yourcreditcardinfo.com/.

- Under the LOGIN tab, click on Forgot Username or Password.

- Tap on I forgot my username.

- To verify your identity enter the following:

- Last four digit of Credit Card number.

- Social Security Number, last four digits.

- Birthdate (mm-dd-yyyy) of the cardholder/ZIP Code as in 5 digits.

- Tap on Lookup Account to retrieve your username.

Reset Password

Look here, if you are unable to remember your account password fully or partially:

- Log on to www.yourcreditcardinfo.com/.

- Click on Forgot Username or Password just below the LOGIN

- Tap on I forgot my password

- To receive the password reset manual, please enter your account username

- Select the Submit to reset the password accordingly.

Read Also.. Complete Roundys Customer Survey To Win $5000 Gift Card

Customer Service

In case of any doubt or complaint, talk to the customer support through the following channels:

- General and Technical:

Dial 1-866-449-4514.

- Lost or Stolen Credit Card

Dial 1-800-556-5678.

References