www6.rbc.com – How to Access RBC Express Account

Login Guide for RBC Express Account:

RBC Express is a special online financial apparatus, which offers online help which provides its users the power over their assets and money, knowledge into your financial data and the importance to safety you have to ensure your business – at home and around the globe. Truth be told, if the business is required faster implementation, you will get help from the mobile app and it will let you remain associated from any place you are.

-

You are hoping to designate financial assignments to workers or other specialist co-ops

-

You have to oversee and supervise countless business accounts

-

You are searching for broad observing and detailing capacities

-

You will make high esteem installments and exchanges

RBC Express gives you propelled usefulness, for example, modified organization and multi-client get to, so you deal with your receivables, payables and capital.

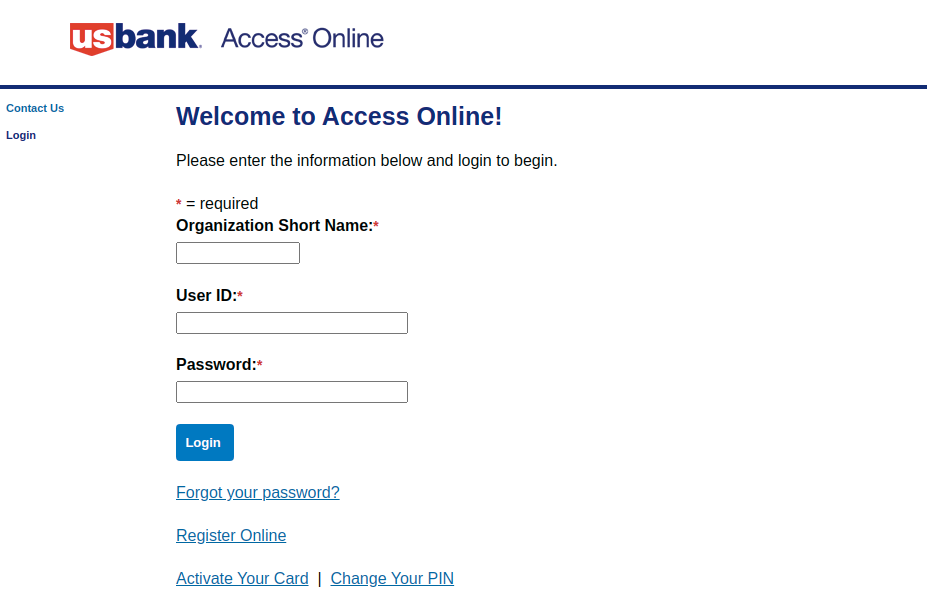

Rbc Express Online Login:

To login open the page, www6.rbc.com

-

As the page appears at the center provide, the sign in ID, password, token number, click on, ‘Sign in’ button.

-

To get sign in help, click on, ‘Get sign in help’ button.

-

To reset password click on, ‘Forgot password’ button. Enter, the sign in ID or email, click on, ‘Send reset instructions’ button.

Frequently asked questions on RBC Express:

-

How would I make an installment gathering?

The initial step to dealing with your installments through RBC Express ACH Direct Payments and Deposits is to make at least one Payment Groups. A Payment Group is an assortment of Payment Records that permits you to assemble comparable sorts of installments. Installment bunches are static and are generally made just a single time

-

What is the contrast among normal and agreement installment gatherings?

-

Standard Payment Groups

Standard installment bunches are an assortment of installments with no related installment recurrence subtleties.

-

Due date:

A typical due date is chosen for all Payment Records of a Payment Group at the time a Payment File is made

On the other hand, individual due dates are chosen for all Payment Records of a Payment Group at the time a Payment File is made

-

Installment Frequency:

Installment due dates are characterized at the time a Payment File is made

Every installment record will just show up in each document once

Would I be able to duplicate records starting with one gathering then onto the next?

You may just duplicate normal installment records starting with one gathering then onto the next. Agreement records might be traded; they can’t be imported as agreements.

-

Would I be able to see/print the substance of an ACH installment record that I just discharged?

-

Normal Payment File

While making a normal installment document, every Valid record with a sum more noteworthy than $0 are incorporated. On the off chance that you have not rolled out any improvements to the gathering since you last made the document, you may acquire a posting of installments from your last file. Contract Payment File: After a contact record is discharged, the substance of your last agreement document can’t be re-created. On the off chance that you have selected to get the Payments Register Report, it will be your wellspring of authentic document content subtleties.

Also Read : Access To Your Maybank Online Account

-

How would I make an installment record?

When you have made at least one Payment Groups, the following stage is to make Payment Records to remember for the Payment Group. A Payment Record is a reusable assortment of directions, for example, a record number or recipient name. Installment Records are static and for the most part made just a single time.

-

How would I change a T-blunder?

A T-blunder is an installment that has been submitted to RBC for preparing, however has been hailed as a value-based mistake. Installments hailed as T-mistakes won’t be prepared until they are rectified and will be erased following 40 schedule days.

Customer contact:

Get contact help by calling on, 1-800-769-2535. International: 1-416-974-3334.

Reference link: