studentaid.gov – Access To Income Driven Repayment Account

Apply for Income-Driven Repayment Online

Federal student loan borrowers can breathe at ease with the Income-driven repayment (IDR) plans. Under these, federal student loan borrowers can easily pay back their student loans if the amount of debt taken is higher than their income. Your Income-driven plan will be determined based on your income, amount of loan, size of family, loan type, and the state you live. Specific situations like emergency and calamities vary the exact plan. Currently, four types of income-driven plans are there into effect:

- PAYE Plan(Pay As You Earn Repayment Plan)

- REPAYE Plan(Revised Pay As You Earn Repayment Plan)

- ICR Plan(Income-Contingent Repayment Plan)

- IBR Plan(Income-Based Repayment Plan)

Under Income-driven Repayment Plan, the percentage of your discretionary income is your payment amount. Depending upon your plan, the percentage may differ. On having a qualified family size and income amount, you may have zero monthly payment at all.

Choosing the right plan

In case, you have already decided regarding the right income driven plan, you must choose a plan that will provide the biggest benefits depending upon your circumstances. As discussed earlier, depending upon the plan you choose, your amount of repayment, time for repayment, the types of the loan will be covered.

On having direct loans, all the four income-driven repayment plans can be chosen. If you are confused regarding the plan, you can choose the one that provides your lowest repayment amount. The servicer will decide the best one for you and place you under a lower paid one.

Application-Initial Process

To apply for the Income-Driven Repayment Plan, you need to first get in touch with your student loan service provider. The loan service provider will be the best person to give consultation about the suitability of a plan.

After deciding the suitable plan, an application called Income-Driven Repayment Plan Request is too submitted. Both online and offline paper form submission method is available for the application.

Other tools in Income-Driven Repayment Plan Account

Online applicants need to create Income-Driven Repayment Plan Account on the said website. Apart from making the application, you can do the following task:

- Free application form for Free Application for Federal Student Aid(FAFSA)

- Making an application for repayment plans.

- Utilizing the Public Service Loan Forgiveness Help Tool.

- Conclude loan counseling.

- Authorizing Master Promissory Note.

Applying Income-Driven Repayment Plan by creating an account online

New Applicants, who have decided the plan is interested to apply online, may go through the following steps:

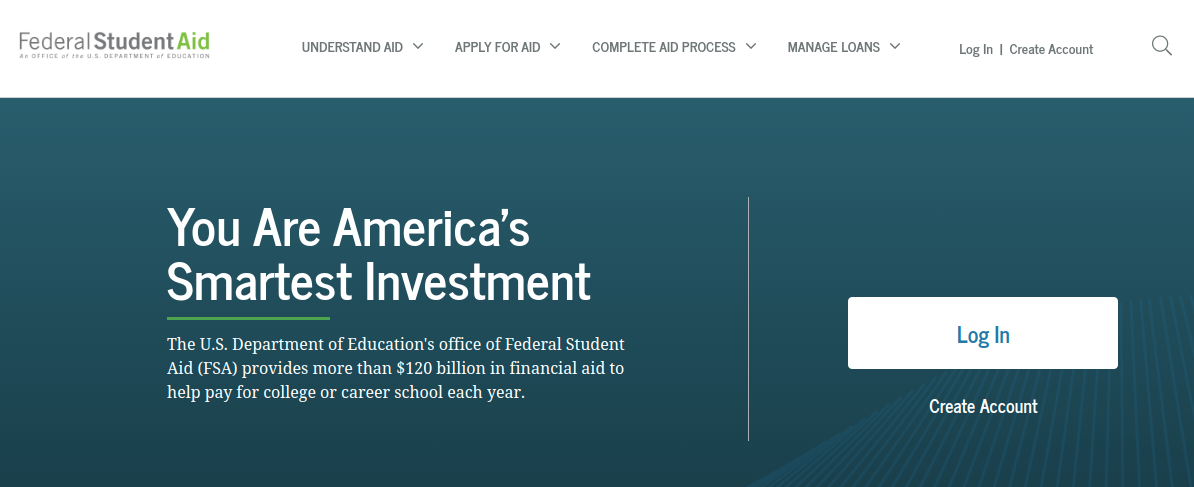

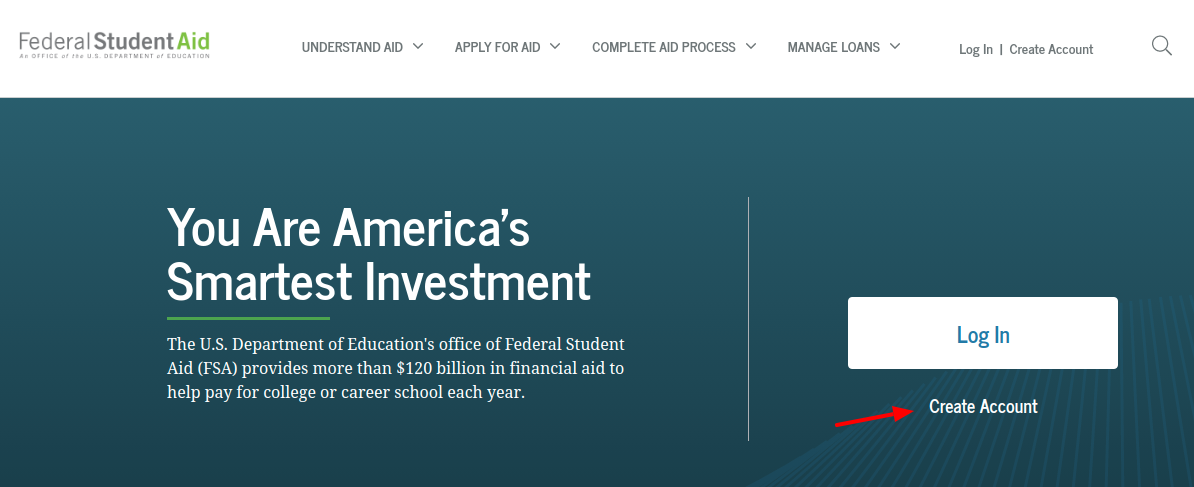

- Open your browser and visit studentaid.gov.

- Click on Create Account tab.

- Tap on Get Started.

- Enter your Personal Information:

- First Name.

- Middle Initial.

- Last Name.

- Date of Birth(mm-dd-yyyy)

- Social Security Number.

- Click on Continue.

- Create account Username. Username must be between 6 to 30 characters with the combination of upper case, lowercase letters, and numbers. You cannot create a username with 10 numbers and no letter.

- Write down your contactable email address.

- Confirm by retyping. It is case sensitive, so be careful to match with the entered email address.

- Create an account Password. Your password must be between 8 to 30 characters with the combination of at least one uppercase, lowercase letter, and number. Password is case sensitive. Do not use personal information such as first or last name, date of birth, SSN, etc. as your password.

- Click on Continue.

- Next, confirm your Permanent Address.

- Address.

- City.

- State.

- ZIP Code.

- Enter Contact Info:

- Mobile Number.

- Retype mobile number.

- Alternate Number(optional)

- In case of an account lock, you can opt for Mobile Phone Account Recovery which is recommended.

- Click on Continue.

- Set up Challenge Questions and their respective answers.

- Please select the reason for creating the Income-Driven Repayment Plan account from the given option.

- Confirm if you have multiple loan account or servicers.

- Choose a suitable Income-Driven Repayment Plan.

- Please confirm of you are in deferment or forbearance.

- Next, enter your number of family members and their status.

- Give details about marital status.

- Mention if your spouse too availed federal student loan.

- If married, please enter your spouse’s social security number, name, and date of birth.

- Both joint applicants with their spouse and the single applicant need to confirm their respective decrease of income after filing the last federal income tax return.

- Confirm regarding the current taxable income.

- Next, upload all the relevant documents regarding your taxable income (your spouse’s too if married) like income from the employment, unemployment programs, interest income, alimony, dividend income, and tips. No need to upload the documents of the un-taxable income like state or federal public assistance, child support, or supplemental security income. Documents like paystubs or certificates where employer mentioning your gross pay will be accepted.

- Upload the digital signature.

- Follow the subsequent prompts to complete the account set up.

- Note that, on uploading the information while creating the account, you do not have to repeatedly upload most of the information for other benefits except when required like renewing your plan and more.

Also Read : Login To Your Chrysler Capital Online Account

Accessing IDR Account for returning applicants

You may need to re-access and login to your account for the following reasons:

- Submitting annual re-certification of your income.

- Switching from the current plan to a new plan.

- Recalculate monthly payments in case of a change in family size or income.

Please go through these instructions to access your IDR account

- Open your browser and visit studentaid.gov.

- Click on login.

- Type in your FSA ID Username/Email Address/Mobile Phone Number.

- Enter your account Password correctly.

- Click on Log In.

Retrieve Username

In case, you forget your FSA User ID, you will still be able to login using your registered email address or phone number. However, if you still want to recover forgotten FSA User ID, here’s how to do it:

- Open your browser and visit studentaid.gov.

- Under New Applicants, tap on login.

- Click on Forgot My Username.

- Tap on Continue Recovering Anyway.

- Select anyone from the three options and proceed to recover your User ID accordingly:

- Text a secure code to my mobile phone. (Mobile number and date of birth)

- Email a secure code. (Email address and date of birth).

- Answer my challenge questions. ( last name, social security number, and date of birth)

- Click on Continue.

Reset Password

There’s no alternative to the account password! You forget one so you reset one! Refer below:

- Open your browser and visit studentaid.gov.

- Under New Applicants, tap on Log In.

- Click on Forgot My Password.

- Type in your FSA ID Username/Email Address/Mobile Phone Number.

- Enter Your Date of Birth (mm-dd).

- Click on Continue to follow the step by step method to recover the password.

- Return to the login page and access using the newly set password.

Customer Support- Federal Student Aid Information Center (FSAIC)

Write to studentaid@ed.gov.

Phone Number

Dial the number 1-800-433-3243 or 1-800-730-8913 (TTY Calls) to speak directly to the customer service representative regarding query, request, or complaint. International callers call at 1-334-523-2691.

Chat

Visit the studentaidgov.com site and go to Contact>Live Chat.

Hours of Operation:

Monday-Friday: 8:00 a.m.-11:00 p.m. ET.

Saturday-Sunday: 11:00 a.m.-5:00 p.m. ET.

Closed on Federal Holidays.

Reference